To all those affected by the Los Angeles wildfires, directly or through friends and family, we offer our support, thoughts, and prayers.

Continue readingAfter the Election: What Investors Can Expect Next

The 2024 election season will likely be seen as one of the most unpredictable and unprecedented election years in modern American history. Despite how it all unfolded and the geopolitical instability abroad, the market remained resilient, with market volatility well-below average compared to other presidential election years. Now that the election has been decided, where do markets go from here?

Continue readingMarkets In A Minute | History Lessons: Market Performance in Presidential Election Years

One month into the new year, and one thing’s for certain: The presidential election will continue to grab headlines and grip the nation’s attention for the better part of 2024. How might this impact investors in terms of perceptions and actual market performance? We explore these questions, in the context of historical data, in this week’s Markets in a Minute.

Continue readingMarkets In A Minute | A Better Balance: Market Review and Outlook

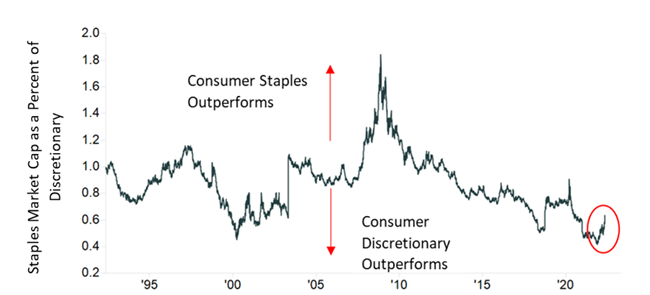

As we look down the open road of a new year, the question is whether the rally that began in 2023 will continue into this year. While there are still plenty of risks (more on this below), there are good reasons to believe the rally has staying power. Still, investment opportunities may look different this year if, as we expect, the rally broadens to sectors and smaller companies that have lagged.

Continue readingMarkets In A Minute | The Impact of Interest Rates on the Economy: How Long and How Variable?

Today we so often hear central bankers discuss “long and variable lags” in monetary policy that it almost appears cliché. But it wasn’t always understood that way.

Continue readingMarkets In A Minute | Presidential Elections and the Stock Market

Like every previous election, the state of the economy and financial markets will be a hot topic of debate among voters and candidates alike.

Continue readingMarkets In A Minute | How Can Investors Benefit from AI?

With the introduction of ChatGPT and other tools that harness artificial intelligence, a new technological revolution has begun, like it or not.

Continue readingMarkets In A Minute: Upside of Down Markets

After finishing 2020 and 2021 with robust gains, the S&P 500 index is down -13.2% this year, through last week. Adding to the pain, the Bloomberg U.S. Aggregate Bond Index is down -8.6% for the same period.

That’s the bad news. The good news is that down markets provide investors with opportunities that may over time enhance returns, reduce risk and provide tax advantages.

Continue readingMarkets In A Minute: Market Volatility

Volatility may not be fun, but it is normal. The market regularly experiences declines. Despite those declines, the market has consistently rewarded those who can patiently see through the short-term volatility, much like the famed investor Charlie Munger and his long attention span. In volatile times such as these, we favor a back-to-basics approach.

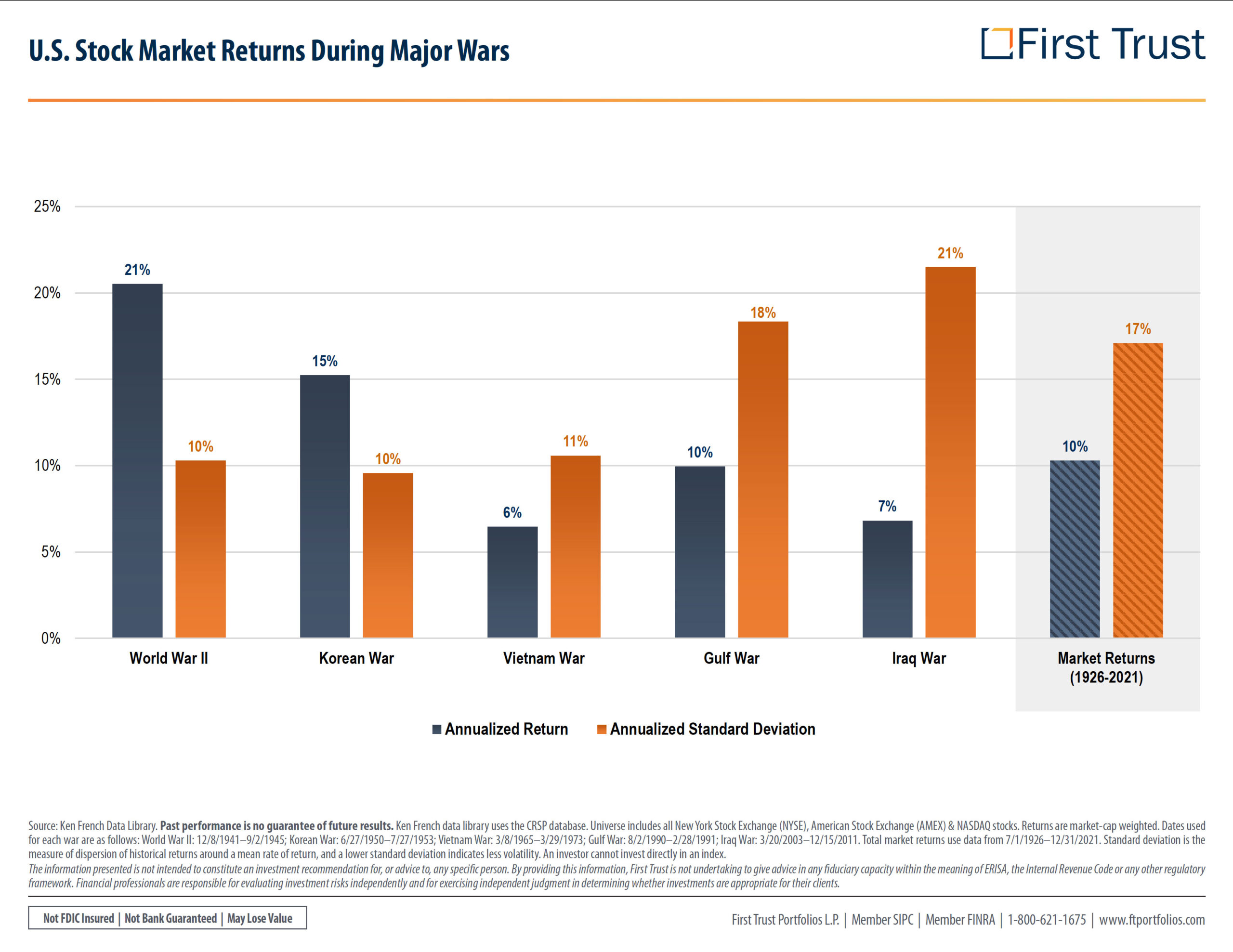

Continue readingRussia and Ukraine Conflict Resources

We will be updating this page with additional Russia and Ukraine Conflict Resources as they become available. Please feel free to contact us with any questions.

Continue reading