“When you come to a fork in the road, take it.” — Yogi Berra

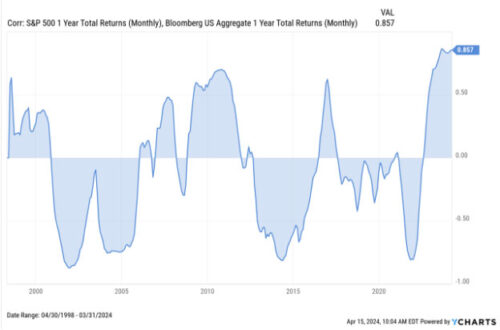

After finishing 2020 and 2021 with robust gains, the S&P 500 index is down -13.2% this year, through last week. Adding to the pain, the Bloomberg U.S. Aggregate Bond Index is down -8.6% for the same period.

That’s the bad news. The good news is that down markets provide investors with opportunities that may over time enhance returns, reduce risk and provide tax advantages.

Indeed, a little courage in the face of adversity can go a long way. As the immortal words of baseball legend Yogi Berra remind us, a little humor can also come in handy when times are tough.

So, what moves should investors consider when markets bring them to a proverbial fork in the road?

Rebalancing Portfolios

The beauty of a thoughtfully constructed portfolio – call the geek police, I think a portfolio can indeed be beautiful – is that it is made up of various securities and asset classes that perform differently from each other, providing the diversification that investors seek. But this diversification also means a portfolio requires regular maintenance or what practitioners call rebalancing.

Rebalancing is a lot like taking your car in for a tune-up after navigating rough roads or taking a long road trip. After big market moves, whether up or down, a portfolio may benefit from some adjustments or even new parts.

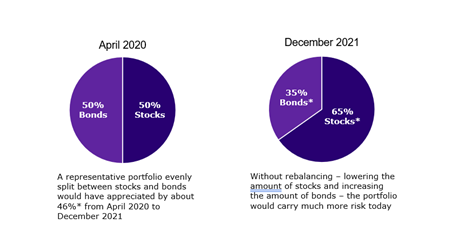

Let’s take a closer look. A hypothetical portfolio that was evenly split between stocks and bonds in late March 2020 would have appreciated by a whopping 46% by the end of December 2021.

Without Rebalancing, Large Market Moves Can Add Risk to a Portfolio

That kind of growth is worth celebrating, but it also introduced greater risk to our hypothetical portfolio by pushing its stock weighting to 65% and lowering its bond weighting to 35%. Rebalancing helps investors ensure that they’re taking an acceptable level of portfolio risk — in other words, a level of risk that reflects their individual time horizon and risk appetite.

In theory, rebalancing also helps enhance returns by providing a systematic process of “buying low and selling high.” It can surely be hard to bring yourself to sell assets that have done well and reinvest in assets that are underperforming. But doing so can be a powerful way of building wealth over time.

Tax-loss Harvesting

How else can investors make lemonade out of lemons in a down market?

Selling assets that have risen in value may result in taxable gains, and that’s no fun. But by selling some holdings that have declined, investors can generate (or “harvest”) capital losses.

They can then use those losses to offset capital gains from winning investments, potentially lowering their tax bill. Investment losses may also be used to offset taxes on ordinary income, with certain limitations.

Dollar-cost Averaging

As we’ve noted, investing when stock prices are low can be a powerful way to generate wealth over time. But from an emotional standpoint, it can be hard to put money in the market when its down and possibly headed lower.

That’s where dollar-cost averaging comes in. By investing a set dollar amount on a regular basis, investors put money to work in the markets, regardless of whether they’re up or down. Over time, it allows investors to take advantage of opportunities to buy shares when they’re on sale, without giving it too much thought.*

*Dollar cost averaging does not assure a profit and does not protect against a loss in declining markets. This strategy involves continuous investing; you should consider your financial ability to continue purchases no matter how prices fluctuate.

Conclusion

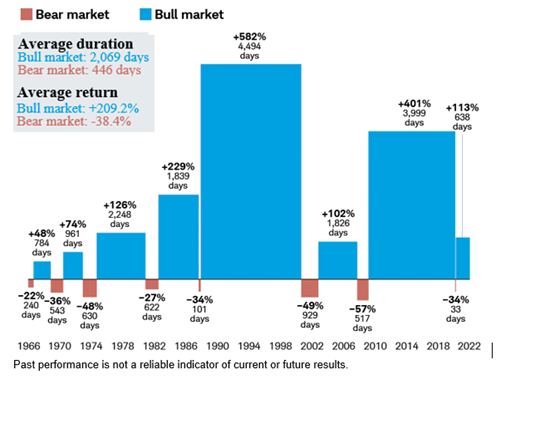

Down markets can be painful, but it’s important to keep in mind that they create unique opportunities and the window for taking advantage of those opportunities can be relatively brief.

Since 1996, bear markets have lasted 446 days on average while bull markets spanned an average of 2,069 days, according to data from the Schwab Center for Financial Research.

To learn more about the history of bear markets and our back-to-basic approach to navigating them, watch Money with Murphy Episode 22.

Meanwhile, to keep things in perspective when markets seem to be headed in one direction — downward — it can help to reflect on another famous Yogi Berra one-liner: “It ain’t over ‘til it’s over.”

Kestra Financial Article by Kara Murphy, CFA