As the year draws to a close, you and your accountant may decide that itemizing deductions can be the right strategy for you.

Continue readingRetiring as a Small Business Owner | 5 Key Steps

Planning for retirement as a small business owner comes with its own set of challenges, and the earlier you begin preparing for the transition, the better.

Continue readingTop 3 Financial Considerations for Women Inheriting Wealth

Whether you are facing the challenge of how to best manage a recent or upcoming inheritance or planning for the transfer of your wealth to the next generation, we are here to help. Allow our team of legacy planning experts to help you put together a plan today to protect those you love now and in the future.

Continue readingPlanning for Medical Costs in Retirement

Whether you’re early on in your working career, approaching retirement, or already transitioning out of the workforce, it’s important to be realistic about what you should expect to pay for medical costs in retirement.

Continue readingMarkets In A Minute: Upside of Down Markets

After finishing 2020 and 2021 with robust gains, the S&P 500 index is down -13.2% this year, through last week. Adding to the pain, the Bloomberg U.S. Aggregate Bond Index is down -8.6% for the same period.

That’s the bad news. The good news is that down markets provide investors with opportunities that may over time enhance returns, reduce risk and provide tax advantages.

Continue readingMarkets In A Minute: Market Volatility

Volatility may not be fun, but it is normal. The market regularly experiences declines. Despite those declines, the market has consistently rewarded those who can patiently see through the short-term volatility, much like the famed investor Charlie Munger and his long attention span. In volatile times such as these, we favor a back-to-basics approach.

Continue readingSocial Security Benefits: What to Do When Your Spouse Dies

Do you have questions about what you need to do to and the steps you need to take to claim social security benefits after your spouse dies?

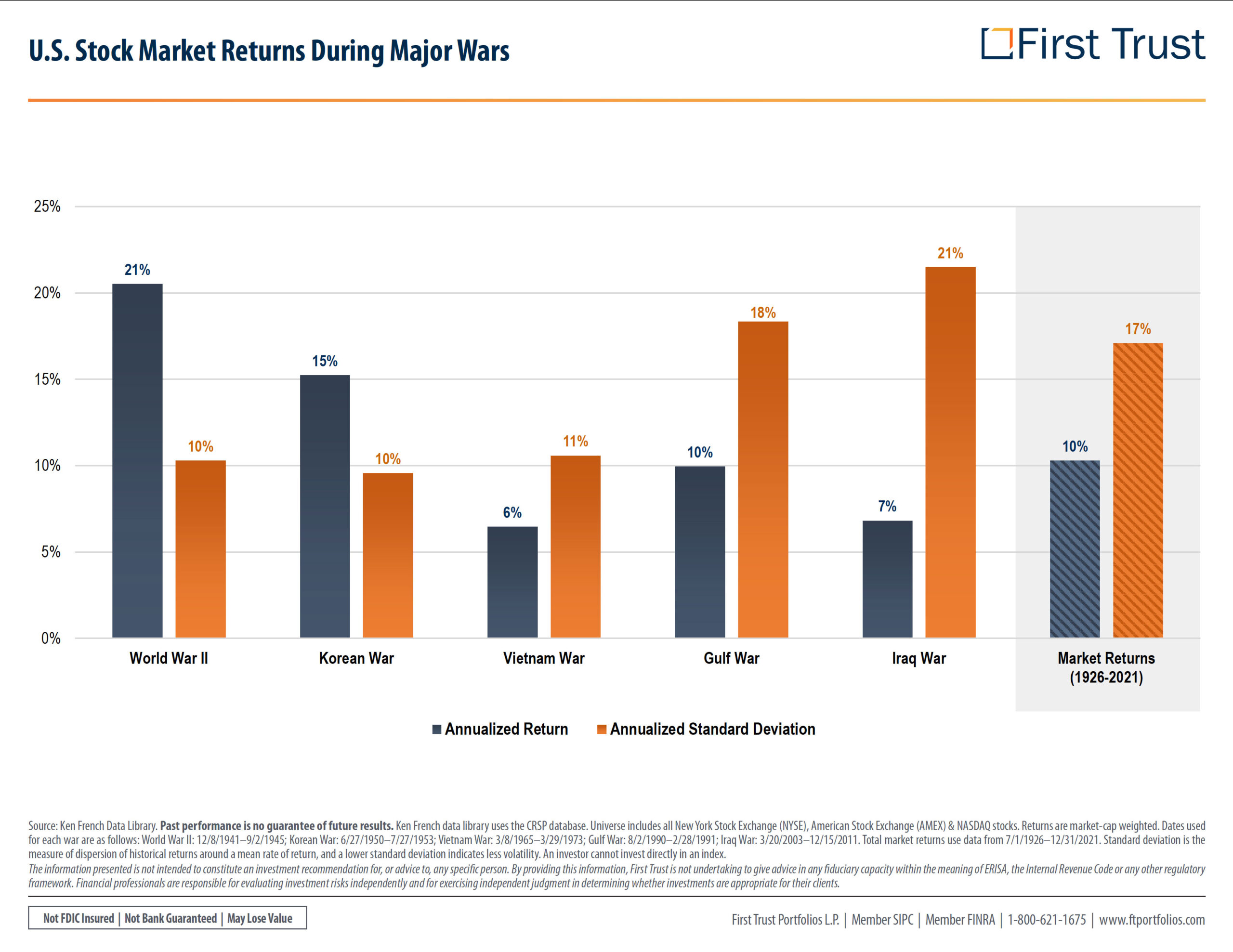

Continue readingRussia and Ukraine Conflict Resources

We will be updating this page with additional Russia and Ukraine Conflict Resources as they become available. Please feel free to contact us with any questions.

Continue readingRetirement Income Planning – No Paycheck?

Whether you’re retiring soon or just getting started, there are questions to answer and steps to take to make sure you’re prepared for what comes next. Think of retirement income planning as your map to the future you wish to create.

Continue readingDivorce Advice for Women: Preparing for Divorce

It’s important to take steps to prepare yourself mentally, emotionally, and financially for your divorce in order to protect yourself and reduce the stress as much as possible.

Continue reading