The 2024 election season will likely be seen as one of the most unpredictable and unprecedented election years in modern American history. Despite how it all unfolded and the geopolitical instability abroad, the market remained resilient, with market volatility well-below average compared to other presidential election years. Now that the election has been decided, where do markets go from here?

Continue readingNavigating the Recent Federal Reserve Rate Cut: Implications and Reassurances

The Federal Reserve’s recent decision to cut interest rates by 50 basis points has sent ripples through financial markets. While this move is intended to stimulate economic growth, it may also have implications for various aspects of your financial life.

Continue readingInvesting and Politics | Does Who Wins Matter to the Market?

It has been conventional wisdom over the years that Republicans are better for the stock market than Democrats, but like a lot of conventional market wisdom, it isn’t always accurate.

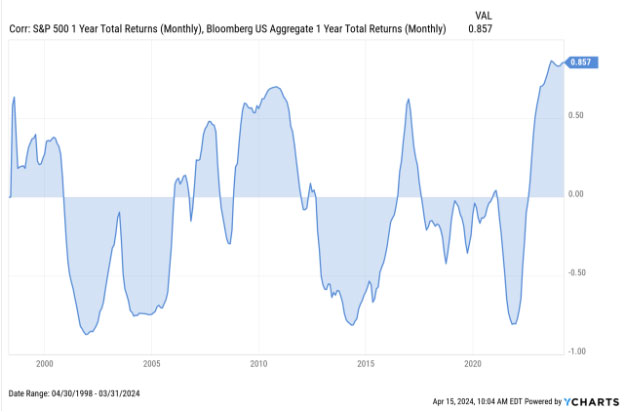

Continue readingThe Evolving Relationship Between Stocks and Bonds

For most of the past quarter-century, stocks and bonds have moved in opposite directions. This movement created what’s called a negative correlation between these two asset classes.

Continue readingCWT Newsletter Q1 2024

A lot has been happening with the team members at California Wealth Transitions and we thought it would be a good time to update you on all that’s been changing with our firm over the past year!

Continue readingMarket Update – April 2024

Dillon Hakes & Guy Kosov discuss the strength in equity markets, recent economic news, geopolitical risks, and the upcoming earnings season.

Continue readingMarkets In A Minute | History Lessons: Market Performance in Presidential Election Years

One month into the new year, and one thing’s for certain: The presidential election will continue to grab headlines and grip the nation’s attention for the better part of 2024. How might this impact investors in terms of perceptions and actual market performance? We explore these questions, in the context of historical data, in this week’s Markets in a Minute.

Continue readingMarkets In A Minute | A Better Balance: Market Review and Outlook

As we look down the open road of a new year, the question is whether the rally that began in 2023 will continue into this year. While there are still plenty of risks (more on this below), there are good reasons to believe the rally has staying power. Still, investment opportunities may look different this year if, as we expect, the rally broadens to sectors and smaller companies that have lagged.

Continue readingMoney with Murphy – China: Struggle to Reignite

Money with Murphy | China: Struggle to Reignite, with Kara Murphy, Chief Investment Officer of Kestra Financial

Continue readingMarkets In A Minute | The Impact of Interest Rates on the Economy: How Long and How Variable?

Today we so often hear central bankers discuss “long and variable lags” in monetary policy that it almost appears cliché. But it wasn’t always understood that way.

Continue reading