Key Takeaways

- Market rally and sector gains: Stocks rallied after the election led by financials, crypto, and small-cap stocks.

- Focus shifts from politics to policy: With the election settled decisively, markets will concentrate on key factors such as the fiscal deficit, potential interest rate cuts by the Federal Reserve and tax policy.

- Policy and inflation concerns: Trump’s proposed fiscal policies, including tax cuts and deregulation, could support corporate profitability but may also contribute to higher deficits and inflationary pressures. These latter factors have helped drive long-term bond yields higher and could slow the Federal Reserve’s interest rate cuts.

The 2024 election season will likely be seen as one of the most unpredictable and unprecedented election years in modern American history. Despite how it all unfolded and the geopolitical instability abroad, the market remained resilient, with market volatility well-below average compared to other presidential election years. Now that the election has been decided, where do markets go from here?

Setting the Scene

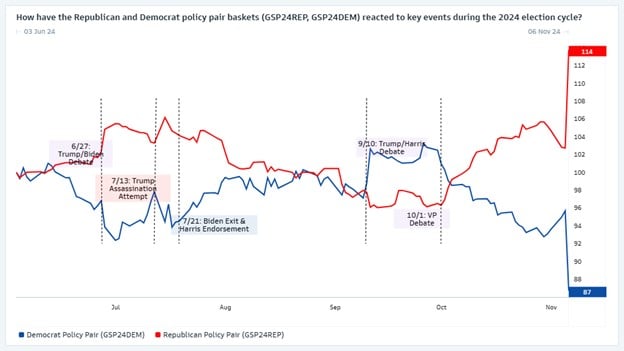

As markets prepared for election day, polling and betting markets suggested that Donald Trump had a slight edge, which triggered a shift in markets. In equities, this led investors to start allocating into companies expected to benefit under a Donald Trump presidency, including financials, energy, and onshoring enablers. The market performance of these companies compared to those expected to benefit under a Kamala Harris presidency fluctuated in response to key events throughout the campaign season. Beginning in early October, markets appeared to firmly price in a Trump victory, a sentiment that persisted through election day.

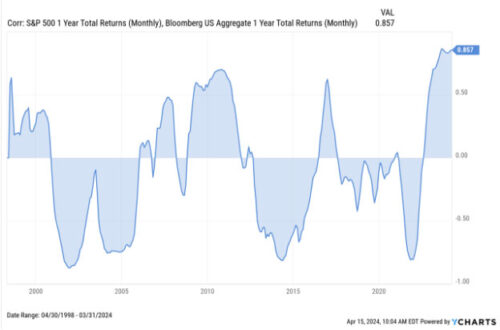

For the last few elections, researchers at Goldman Sachs have identified US equities that could benefit from Republican and Democrat administrations. Researchers then grouped these companies into separate “policy baskets” for each party. As shown in the chart below, shifts in confidence between a Republican versus Democrat victory caused one basket to outperform the other at various points in the campaign season.

Republican and Democrat Policy Baskets (Indexed to 100)

Past performance is not indicative of future returns. Source: Marquee/Goldman Sachs. Data from June 3, 2024 through November 6, 2024.

The morning after the election, the S&P 500 rallied. Financials, crypto, and small-cap stocks were among the top performers on the day. Companies in these spaces are expected to be the biggest beneficiaries of potential de-regulation, tax cuts and increased mergers and acquisitions.

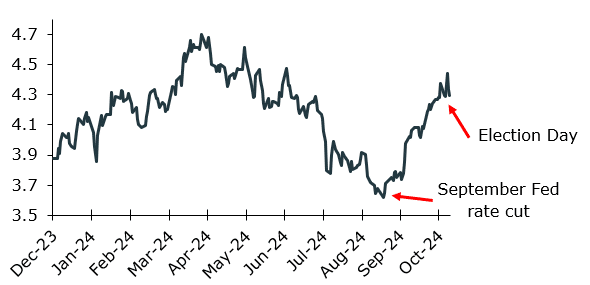

Bond markets also shifted in the run-up to the election as evidenced by the rise in long-term bond yields, which started to rise shortly after the Federal Reserve cut interest rates in September. The 10-year yield has risen 70 basis points since the September cut, likely due to a combination of factors including shifting monetary policy expectations amongst robust economic data. The election-related contribution to the rise is related to the inflationary impact expected from deficit spending, tariffs, and tax cuts. The morning after the election, bonds sold off and the 10-year yield rose by 15 basis points, nearly replicating the bond market’s reaction to the 2016 Trump victory when the 10-year yield rose 20 basis points. By Friday, the 10-year yield returned to its pre-election day level.

10-Year Treasury Yield (%)

Past performance is not indicative of future returns. Source: Kestra Investment Management with data from FactSet. Data from December 31, 2023 through November 8, 2024.

What We’re Watching For

Contrary to expectations that the election could take days to finalize or even face contestation, the result was clear early, which positively influenced equity sentiment. Key areas of focus for the markets now include deficits, the future path of federal interest rate cuts and tax policy.

Deficits

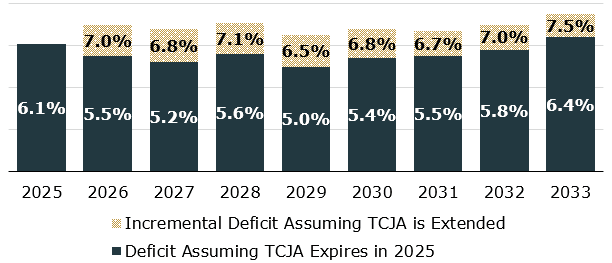

While Trump promises both tax cuts and lower inflation under his administration, he faces a more challenging environment compared to 2016. Inflation remains above the Fed’s targeted 2%. Additionally, the deficit (as a percentage of GDP) in 2016 was 3.2% compared to 6.3% today. Projections suggest that deficits could run from 6.5%-7.5% through 2033 assuming most provisions of the 2016 Tax Cuts and Jobs Act are extended. These figures do not account for Trump’s proposal to reduce the corporate tax rate from 21% to 15%.

Tax Cuts: Impact on the Deficit

NOTE: This material represents an assessment of the market environment at a specific time and is not intended to be a guarantee of future results. Source: Kestra Investment Management with data from PIMCO, Congressional Budget Office, The Budget & Economic Outlook, The Tax Foundation. Data as of April 2024.

All things equal, this scenario could lead to a prolonged period of elevated long-term bond yields relative to recent history. Higher long-term yields would negatively impact smaller companies which tend to rely more on debt.

Federal Reserve

As of November 8, markets are implying a 65% chance that the Federal Reserve will cut interest rates by 25 basis points at the December meeting. While many believed the fight against inflation was over and the Fed’s focus was squarely on employment, Jerome Powell acknowledged in the November meeting that the most recent inflation data was higher than expected. He also stated that the committee will continue to make decisions meeting by meeting.

The market will be watching to see if “higher for longer” turns into “high for longer.” Tariffs, tax cuts and continued deficit spending could exert additional inflationary pressure, forcing the Federal Reserve to slow down the pace of interest rate cuts. The Fed’s delicate balancing act between managing inflation and supporting employment isn’t quite over yet.

Taxes

With Republicans in full control of the presidency, House and Senate, legislators are likely to extend the Tax Cuts and Jobs Act and may look to pass additional tax cuts. However, the slim majority in the House may complicate tax policy efforts. For instance, further reductions in the corporate tax rate and eliminating taxes on tips, overtime, and social security income may face hurdles.

Bottom Line

Markets value certainty, and with a clear winner early and a sweep of Congress, investors have received, at minimum, a higher degree of certainty. With the election behind us, markets can turn their focus to corporate profitability and economic fundamentals, which are the primary drivers of returns, not the person or party in office.