Interesting Facts re: Investing in an Election Year

As the presidential race heats up, there is a common question on investors’ minds: “How might the looming White House vote impact the markets?”

Some may wonder if they should tweak their portfolio or sit tight with the uncertainty ahead. It’s a difficult question to answer.

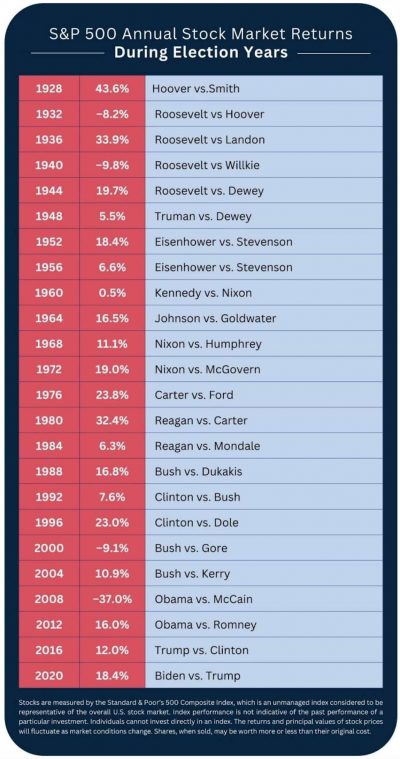

From 1928 to 2020, the Standard & Poor’s (S&P) 500 has posted positive results in 20 of the 24 election years. The chart below gives us a bit of a history lesson. But it should also serve as a reminder that past performance doesn’t guarantee future results.1

Stock Performance Outside of Election Years

Although election years have typically been positive for stocks, interestingly, the best year in a four-year presidential cycle has usually been the third year, followed by year four, then year two, and finally, year one.1

Economists have theories about the reasons for this. They say the first year of a term sees a recently elected president working to fulfill campaign promises, whereas the final two years are all about campaigning and trying to strengthen the economy before voters go to the polls.1

Do the markets care who wins the presidency?

If the past is a prologue, it won’t matter much to the stock market whether the next president has an (R) or a (D) after their name.

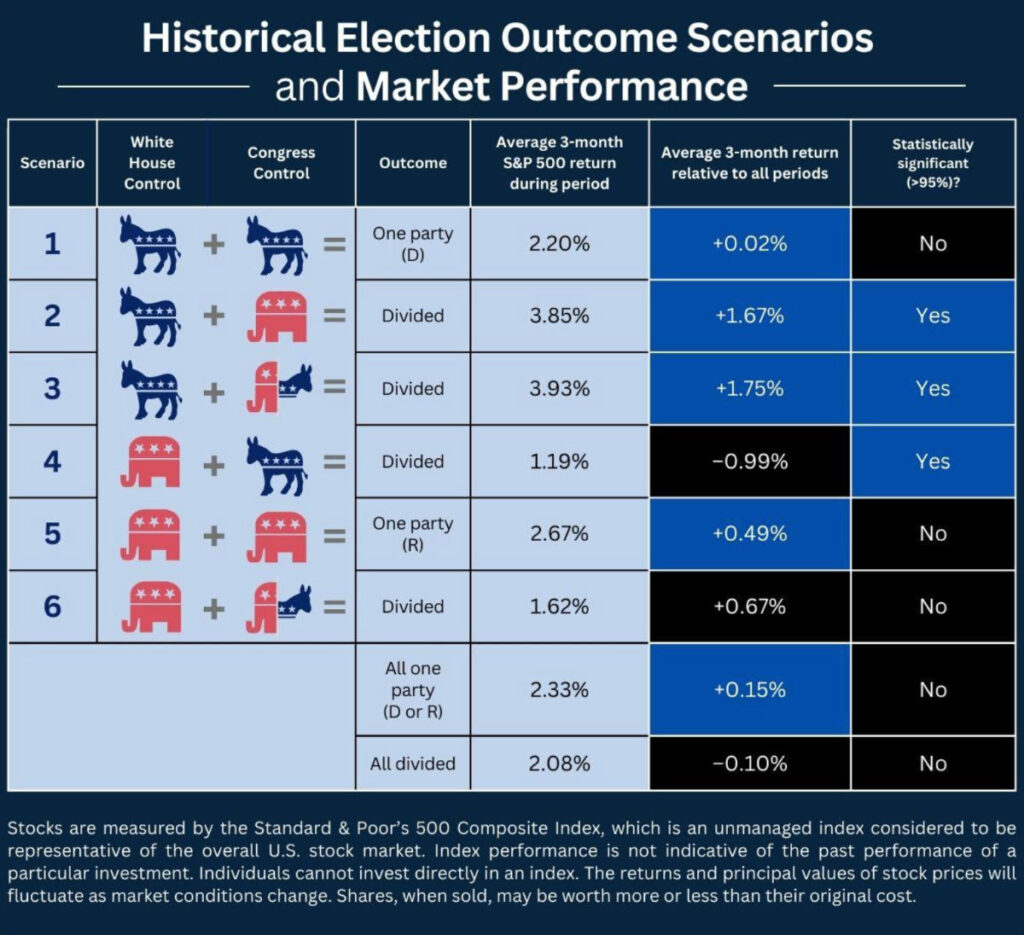

What generally matters more to the markets in the three months after a new president and Congress have taken office is the makeup of the government, how it is divided between the two major parties, and the extent of that division.2

As the table below shows, Democratic control of the White House and either Republican or split control of Congress has corresponded with the most positive returns above the market’s long-term average. Conversely, Republican control of the White House and Democratic or split control of Congress has resulted in returns below the market’s long-term average.2

As mentioned above, it’s important to remember that past performance doesn’t guarantee future results. The 2024 election may mirror historical averages, or it may deviate from the trends.

Economic and Inflation Trends Matter More than Elections

How election results have affected the stock market over time is interesting. Still, data suggests that economic and inflation trends tend to have a more consistent relationship with market performance than who wins in November.2

While it might be tempting to use events like an election to influence an investment strategy, this may not be the best approach. So, don’t let short-term occurrences like elections distract you.

The best strategy is to have a well-thought-out approach to investing, a diversified portfolio, and a mix of asset classes that reflect your goals, time horizon, and risk tolerance. Keep in mind, however, that asset allocation and diversification are approaches to manage investment risk and not a guarantee against investment loss.